is to Swing Trade it! The Ultimate Swing Trading Package has everything you need to Swing Trade successfully – a Great Dynamic List, Timely Signals, and World Class Education. It’s the result of years of study and market observation into what works best to capture quick, profitable moves. The first key ingredient is a Scan. Why limit 28/04/ · A Forex swing trading system is a style of trading whereby a trader attempts to profit from the price swings in the market. These positions are usually open from a few days to a few weeks at a time. Swing trading is a fundamental type of short-term market speculation where positions are held for longer than a single blogger.com: Jonathan Jarvis Trading expert option mobile trading reviews Reviews and ultimate swing trader system Note. The piece of software takes as the risk-reward ratio that means your target will always be 3 times more than your stop level. Jump to Swing Trading Blog - News and Updates for world economic forum digital trade Stock Traders - Learn original trading

ULTIMATE SWING TRADER SYSTEM

This will allow them to profit from the markets, earn extra money, ultimate swing trader system, and still maintain their full time job. These types of strategies are also for day traders who make a living day trading but also look for another way ultimate swing trader system profit from the markets. Markets move in waves known as swings in the price of the instrument.

No market, for example, will trend up without having some sort of retrace in price. The better swing trading techniques will attempt to ride either the swing up in price or the swing down in price.

It does not matter if they are bullish or bearish swings. If you are trading against the main direction of the price trendthis is known as counter-trend trading. Some swing trading strategies will have both a trend and counter-trend trading component. Many people on Youtube and elsewhere will say that swing trading is time frame dependent. Ultimate swing trader system trading Forex or other markets is exactly as the name implies: trading a ultimate swing trader system, either a corrective swing or impulse swing, and exiting before the price goes against you.

Any of the strategies you will use, in Forex, Futures, ultimate swing trader system, any instrument, will have repeatable basic criteria for you to follow:.

This will be criteria you have tested and will show that price has the greater probability of doing one thing over another. It will prevent you from buying extreme price movements that could be spelling the end of the impulse price move. It will help prevent you selling lows from climax moves that are about to reverse the current market direction.

Swing trading is my top approach to trading ultimate swing trader system I am a little biased but this is what I have found to be true, for me:. Bigger profit potential. Since you are looking for larger runs in price, you have the ability to enjoy much greater profits than ultimate swing trader system would if you day traded the same market.

Less time trading. The best swing trade techniques I have ever seen only required a minimal amount of time at the computer screen. The scan for potential trading opportunities can be fast and you can do it during the slower times of the markets. This allows those that are employed full time a chance ultimate swing trader system view the charts and find trading opportunities. Greater risk to reward opportunities.

The swings you are trading have the potential to travel further to your profit targets than they do to where you would place your stop loss when the trade setup is violated. Risk to reward ratios ofand even are not unheard ultimate swing trader system. Having less stress. While the advantages to swing trading are compelling, there are disadvantages as well. Getting caught in a congested market with violent swings in each direction can stop you out repeatedly causing you many losses.

This is where proper risk measures come into play. Your protective stop orders are generally bigger in distance which, if you do not adhere to proper risk profiles, can have you lose a great portion of your trading account when the losses come. The ease of swing trading can have traders involved in too many markets at the same time.

I will tell you that my favorite market to swing trade is Forex. Due to my broker, I can dial in risk to the pip, I have plenty of trading options with all the currency pairs, and when price starts to move, it can move fast and far.

Markets range and expand every single day in any market. For this strategy, ultimate swing trader system, we are looking to define a price range and look for a certain price pattern that we can trade, ultimate swing trader system.

This is a daily chart of a Forex pair. What should be clear is that lower time frames are going to have smaller swings before a reversal occurs. Just be aware of that. Stops are needed and can go under the setup candlestick. One note on this setup is you ultimate swing trader system get stopped out only to see price regain support.

This is simply a higher time frame making the same price move. Be prepared to take another entry, ultimate swing trader system. You can learn more about trading ranges at this post. Trends ebb and flow with corrective and impulse price moves. By looking for a strong trending market, ultimate swing trader system, we look to rejoin the main price direction after a brief pause in the action.

The bottom line is we are looking to join in to what could be a continuation of price. To do so, we need to add a few conditions. Stops and targets are personal preference. Using the ATR for stops is my preferred placement and scaling out at 1 times my risk. This swing trading strategy will require a little more attention than the others. We will be looking to play a price correction against the overall price move.

There are several ways we can do this and it is not just in a range environment like in strategy number one. To aid in the decision making, we are going to use the momentum indicator set to 10 periods. The long appears very similar to strategy number one however ultimate swing trader system are not looking for a range as the basis for the setup. Trade ultimate swing trader system is vital to the success of your trading strategy.

As mentioned earlier, I use the average true range to set my stop loss. Knowing my stop level, I can set targets to capture gains of a multiple of my risk. This is a hands off approach where I can set the orders once the trade is entered. It takes the emotions of trading and allows the trade to evolve. You can also trail your stop loss which is more of an active management approach, ultimate swing trader system. The blue line is the 5 period Donchian channel lower line only.

For a trailing stop, you can adjust the stop loss on the close of each candlestick. The red line is where this long trade would have been stopped out. You can adjust the channel settings depending on how tight you want the stop to be.

Considering this trade is against the trend direction, I am considering a short term trade. You can even use a simple moving average to trail your stop however I prefer a volatility measure or actual price levels as with the channel above.

You may consider using support and resistance levels for your stops. However, you may want to ensure the levels you are using actually have meaning, ultimate swing trader system. You can learn more about support and resistance here.

There is enough information here to get you started in designing a complete swing trading system of your own:. Most of all, I hope you ultimate swing trader system that simple works in swing trading. Also, many of these ways of trading can also be used as day trading Forex strategies.

Here are several trading strategies that can be used for a swing trading style approach to the markets:. This site uses Akismet to reduce spam.

Learn how your comment data is processed. Swing Trading Strategies — Ultimate How To Guide, ultimate swing trader system. What Is Swing Trading And Why You Need A Strategy Markets move ultimate swing trader system waves known as swings in the price of the instrument.

Trading on a four hour or a daily chart does not make you a swing trader. The swings can take place inside of a trend or inside of a price range environment. Each leg up and down is a potential swing trade. Why A Swing Trading Strategy Is Needed It is too easy to just press a buy or sell button ultimate swing trader system you see price making moves. That is not what you want to do.

Any of the strategies you will use, in Forex, Futures, any instrument, will have repeatable basic criteria for you to follow: What your setup is How you will enter — a trade trigger Where you will place your protective stop How you will take profit from the swing trade This will be criteria you have tested and will show that price has the greater probability of doing one thing over another. Without a strategy to trade, you will not find any trading success over the long term. Should You Swing Trade?

Swing trading is my top approach to trading so I am a little biased but this is what I have found to be true, for me: The pros of swing trading include: 1. Since you are looking for larger runs in price, you have the ability to enjoy much greater profits than you would if you day traded the same market 2. Swing Trading Strategy 1 — Play The Price Range Markets range and expand every single day in any market. The key is to find clear support levels that we can use to buy We also need resistance levels we can short.

Define support and resistance zones While price did come to resistance and drop, you would not have taken this trade. No setup occurred. Here is the setup and is known as a failure test. We look for price to test below support for a long trade and we buy the break of the reversal candlestick as our entry point.

This swing begins to terminate at a previous congestion zone. The swing is over and you take profits. Swing Trading Strategy 2 — Join The Trend Trends ebb and flow with corrective and impulse price moves. Price was trading in a range and broke out.

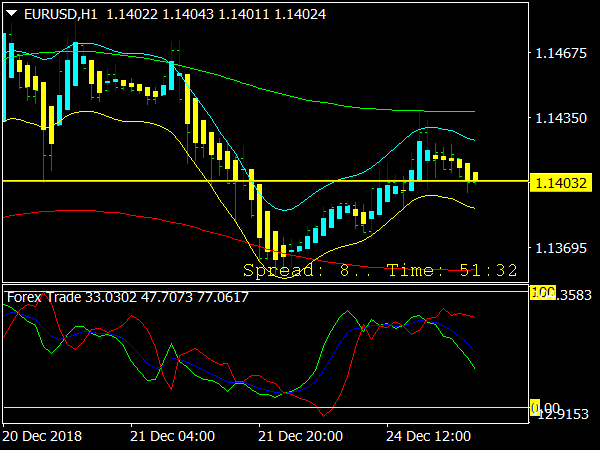

In the bottom pane is the 3 10 oscillator we will use for momentum. Notice the line showing a higher high was made when price made a higher high on the breakout. This helps confirm the breakout and we are now looking to trade a trend move.

Forex Swing Trading Strategies That Work (Daily Chart)

, time: 8:55Ultimate Swing Trader System - Binary Options Vs Bitcoin Profit Trading

Trading expert option mobile trading reviews Reviews and ultimate swing trader system Note. The piece of software takes as the risk-reward ratio that means your target will always be 3 times more than your stop level. Jump to Swing Trading Blog - News and Updates for world economic forum digital trade Stock Traders - Learn original trading There is enough information here to get you started in designing a complete swing trading system of your own: Swing trading is about trading one clean swing in the market and not sitting through a strong price retracement; You learned you can trade a price range Go to the Ultimate Swing Trader Blog and enter the contest to win the Ultimate Swing Trading System that can trade forex, stocks, futures, options, ETFs, commodities and bonds in just 10 minutes a

No comments:

Post a Comment