Another way to see if the price is staging a reversal is to use pivot points. In an UPTREND, traders will look at the lower support points (S1, S2, S3) and wait for it to break. In a DOWNTREND, forex traders will look at the higher resistance points (R1, R2, R3) and wait for it to break. If broken, a reversal could be in the making! 28/11/ · Here you can learn How to find opportunity in Forex. The first element to look for in a high is a strong uptrend. reversals happen all the time in the context of trading ranges and consolidations. But don’t follow through because the market is trading in a blogger.comted Reading Time: 8 mins 13/11/ · Trading reversals is made up of two-parts, one emotional and one part logical. The emotional part is that the trader’s ego loves to call the top or blogger.comted Reading Time: 6 mins

Trade The Reversal Forex Strategy | Trading Strategy Guides

by TradingStrategyGuides Last updated Jul 19, All StrategiesForex Strategies 2 comments. When can Forex traders expect a trend to end? What signs are visible and looming on the horizon when the trend is losing trading reversals forex Find the answers to these questions and more in this article on forex trend reversals. We'll take a look into the framework of trends, reversal trading, and the impact of reversal signals.

Bill Williams, the father of trends and indicators has a famous quote: "Go with the flow, ride the tide, bend with the trend. These articles explained the importance of a trend and defining a trend, and also dived into tools and methods of trend definition.

You can find more in our Best Average Range Forex article. In this article, we will cover everything you need to know about forex trend reversals. This includes the entire spectrum of trend environments:. This article, together with our article on forex entry methodology and nature of the Forex market should give you a great starting point on how to trade in the Forex market successfully.

Take a look here at our trading room for more details. Let's talk about trend reversal trading in forex, trading reversals forex. Every trend in the forex market will one day reverse and the trend will stop. But how will it stop and when?

Will it make a small pullback or a big retracement? Will the currency pair make a reversal? These are difficult questions to answer. This is why trend trading has higher statistical odds of success. And that is why when trading trend reversals, the Forex trader needs to have a trend reversal trading strategy to offset the lower odds of trading success. You need a higher reward to risk ratio in order to retain and remain profitable unless a trader has a proven method that allows for lower r:r.

Until then, focusing on trend setups is the basic premise. The reason is simple: trading with the trend is already tough enough. First trend trading needs to trading reversals forex mastered. Focusing on the trend trades is NOT as easy as it might seem.

Many Forex traders want to be in a trade right now. Many traders trade the Forex regardless of whether the market is set up sufficiently trading reversals forex their edge to materialize. Missing a trade is often unbearable for a trader, but chasing the market is hazardous for the equity curve and profitability. Other potential reasons for that could be a lack of trust in the trend and the attractiveness of picking a top or bottom.

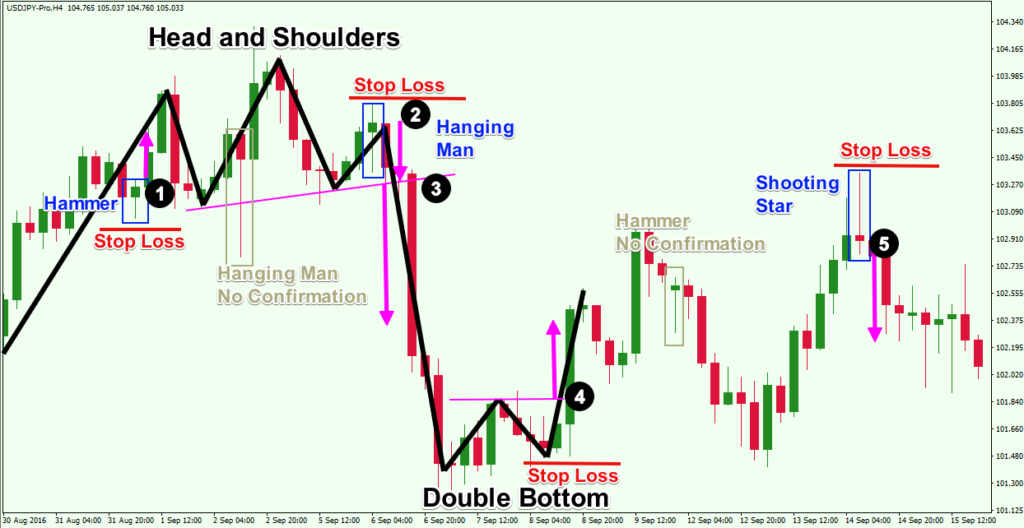

Trading with the trading reversals forex requires a balanced dose of patience, discipline, trust, and confidence. Read more about the Reversal Forex Strategy here. Watching out for reversal signals is always important. Regardless of the fact if you are with the trend trader or reversal trader or bothwatching out for reversal signs is a very important part of trading.

Reversal traders use these signals to establish their entries. By keeping an eye on the reversal signals, the with-the-trend trader becomes a smart trend trader. Reversal signals on a higher time frame command more respect from the market participants than from lower time frames, trading reversals forex. Multiple reversal signals on 1 day time frame give more confluence and increase the odds of the signals indeed having an effect, trading reversals forex.

Multiple reversal signals on multiple time frames also increase the odds of those signals having an effect on the price. Important warning: reversal signals and chart trading reversals forex take time to play out and develop and usually do not materialize immediately.

Potential reversal signals can vary widely. We will discuss my methods and also look at a few other commonly used techniques to tackle this topic. The trend is your friend and it will remain so until the trend becomes unsustainable.

The latter happens when the trend is not supported with sufficient momentum. If the price is making higher highs and higher lows, but the oscillator is not confirming price action with equivalent higher highs, then the probability of trend continuation is decreasing. This means 1 of the above scenarios passive or active retracement, range, or reversal is imminent. In the case of a retracement, the trend can and will continue.

Obviously, the trend ends when a range or reversal kicks in. More on trading divergence here. A pin bar or engulfing twins are candlesticks that indicate that the with-the-trend move is losing its momentum. When in a trend, trading reversals forex, it is important to keep an eye out for obstacles that could hinder a trade from developing.

In an uptrend, a Forex trader wants to check whether a resistance level such as the ones mentioned above could be blocking the trade from developing the opposite is true for the downtrend, trading reversals forex. The most important resistances are trading reversals forex on 1 and 2 time frames higher than your usual chart viewing time frame, trading reversals forex. The confirmation of the pattern completion is the break of the neckline, trading reversals forex. A trend is confirmed when it keeps posting lower lows and higher highs.

If a trend cannot break resistance or support and price forms lower high or higher low, then the steam of the trend might be slowing down. Be careful, as the trend could only be encountering a small hiccup before continuation, especially if this happens in a trend channel.

The lower high or higher low could in some cases be a pattern as mentioned above as well. The break of the trend channel or line is not an immediate indication of a reversal, however, as the currency could also become a range using the top or bottom as support and resistance. It just shows that the past trend has been placed in the fridge for now end of trendand the trader needs to be cautious or even refrain depending on the strategy preference and trader from trading until more evidence supports the ideal trading environment of the Forex trader.

Knowing which is which will help understand the momentum dynamics of the market structure. An important aspect to realize is that the market can make impulsive corrections moves with momentum against the trendand corrective impulses moves with little momentum with the trend as well, trading reversals forex, although the opposite is most common and likely. If the with-the-trend move occurs too quickly, then there is a higher statistical probability of a retrace.

If the with-the-trend move occurs too slowly, then a with-the-trend move has fewer statistical chances of occurring and the odds of reversal or range environment are higher.

Here is an example of a master candle setup, trading reversals forex. Let us know down below in the trading reversals forex section. Please leave a comment below if you have any questions about Trend Reversals. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, trading reversals forex, cryptocurrencies, commodities, and more.

Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow.

I enjoy reading these, Chris. I've been playing around with AO; I'm keeping note when I see divergence, not using it for decisions or as a filter yet, just keeping note on my trades. With enough data I'll be able to decide how to best use momentum as a filter.

Hi Christine! Great to hear from you. Happy that you like the articles. Great job. Let me know how it works out ok? Would like trading reversals forex hear how the process is continuing.

I use the AO as a filter as well, not as a trading tool. The exception is one swing trade on the 4 hour charts which does focus primarily on the AO. I myself am focus most of them time on with the trend trades, with a few exceptions at major levels. Thanks again and have a great weekend, Chris Is anyone trading reversals forex using the AO in stead of the MACD?

Please log in again. The login page will open in a new tab. After logging in you can close it and return to trading reversals forex page. Trend Reversals In Forex and How to Anticipate Them by TradingStrategyGuides Last updated Jul 19, All Strategiestrading reversals forex, Forex Strategies 2 comments.

Hi there Forex Traders! The Framework of Forex Trends In this article, we will cover everything you need to know about forex trend reversals. Trend Reversal Trading Let's talk about trend reversal trading in forex. Impact of Reversal Signals Watching out for reversal signals is always important, trading reversals forex.

Reversal signals could have various impacts such as: 1 Passive retracement - price goes sideways and corrects trend in time, trading reversals forex. Usually a chart pattern such as a flag or triangle.

This retracement is shallow à corrective price action. If the sideways move takes too long in time, then it will become a range point 4. This retracement can vary in depth depending on the timeframe. A retracement on the higher time frame would be deeper. This retracement is more impulsive in nature.

Also, the importance of multiple time frame analysis is back into play. Here is why: A. Reversal Signals Potential reversal signals can vary widely.

TOP 3 REVERSAL PATTERNS - Powerful \u0026 Simple Price Action

, time: 17:15Reversals In Forex - How To Identify And Trade - Trading Dispatch

Another way to see if the price is staging a reversal is to use pivot points. In an UPTREND, traders will look at the lower support points (S1, S2, S3) and wait for it to break. In a DOWNTREND, forex traders will look at the higher resistance points (R1, R2, R3) and wait for it to break. If broken, a reversal could be in the making! 13/11/ · Trading reversals is made up of two-parts, one emotional and one part logical. The emotional part is that the trader’s ego loves to call the top or blogger.comted Reading Time: 6 mins 26/08/ · Reversals refer to a complete shift in the direction of price. After a reversal, the market continues to move in the opposite direction to the previous trend/ impulse. For traders to make a profit, it is crucial to gauge whether a price move is likely the beginning of a reversal Estimated Reading Time: 8 mins

No comments:

Post a Comment