You can trade Exchange Traded Options (ETOs) on our fully integrated platform. Both share trading platforms provide you with the tools you need to execute on your Options Strategy. Our Pro platform boasts a professional interface, and is a powerful tool to boost efficiency for active traders 15/03/ · Overall, the best options trading platform for a wide range of investors is Tastyworks. Unlike other investing platforms, Tastyworks has a strong emphasis on options trading. It features tools to quickly analyze and enter trades, along with unique tools to help experienced investors be more efficient in blogger.comted Reading Time: 9 mins E*TRADE charges $0 commission for online US-listed stock, ETF, and options trades. Exclusions may apply and E*TRADE reserves the right to charge variable commission rates. The standard options contract fee is $ per contract (or $ per contract for customers who execute at least 30 stock, ETF, and options trades per quarter)

5 Best Options Trading Platforms for | blogger.com

The best options brokers offer low options contract fees, quality trading tools, an abundance of high-quality research and the customer service necessary to support everyone from beginner investors to advanced traders. While most of the brokers on our list of best brokers for stock trading would be a good pick for options as well, this list highlights brokers that excel trade us options online areas that matter most to options traders.

Many of the below brokers also appear on our list of best online trading platforms for day trading. See our post on how to choose an options broker and our options guide for more on what can make or break an options trading experience. NerdWallet's ratings are determined by trade us options online editorial team. The scoring formulas take into account multiple data points for each financial product and service.

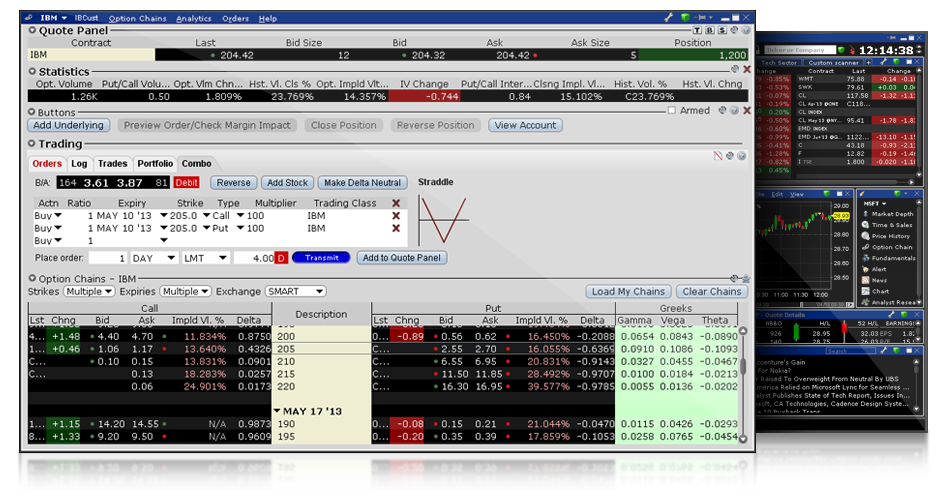

Commission-free stock, options and ETF trades. Website can be difficult to navigate. Commission-free stock, trade us options online, ETF and options trades. Interactive Brokers' IBKR Lite is a strong option for frequent traders: The broker offers international trade capabilities, no stock-trading commission and a quality trading platform, trade us options online.

Over 4, no-transaction-fee mutual funds. NerdWallet users who sign up for IBKR Pro get a 0. Webull will appeal to the mobile-first generation of casual investors with its slick interface for desktop and mobile apps, but the brokerage also delivers an impressive array of tools for active traders. However, its relatively weak educational content may trade us options online true beginners in the lurch, and it lacks access to trade us options online few common asset classes.

Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Still, if you're looking to limit costs or trade crypto, Robinhood is a solid choice. cash credit with a qualifying deposit. Trades of up to 10, trade us options online, shares are commission-free.

Free trading on advanced platform requires TS Select. No transaction-fee-free mutual funds. Zacks is a great choice for experienced and active investors who would appreciate a little extra support from a representative, but trades cost more than at competitors. Disclosure: The author held no positions in the aforementioned securities at the time of publication. brokers and robo-advisors by assets under management, along with emerging industry players, using a multifaceted and iterative approach.

Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgments on which ones will best meet your needs, trade us options online. We trade us options online data directly from providers, and conduct first-hand testing and observation through provider demonstrations. Our process starts by sending detailed questionnaires to providers to complete. The questionnaires are structured to equally elicit both favorable and unfavorable responses from providers.

They are not designed or prepared to produce any predetermined results. The final output produces star ratings from poor one star to excellent five stars. Ratings are rounded to the nearest half-star. Evaluations vary by provider type, but in each case are based upon the weighted averages of factors that include but are not limited to: advisory and account trade us options online, account minimums and types, investment selection, investment expense ratios, trading costs, access to human financial advisors, educational resources and tools, rebalancing and tax minimization options, and customer support including branch access, user-facing technology and mobile platforms.

Each factor can involve evaluating various sub-factors. The factors considered, and how those factors are weighted, change depending upon the category of providers reviewed. Provider categories include: Best Brokers for Stock Trading, Best Brokers for Beginners, trade us options online, Best Brokers for Day Trading, Best Brokers for Options Trading, Best Discount Brokers, Best Brokers for Free Trading, Best Investment Apps, Best Brokers for Penny Stocks, Best IRA Brokers, Best Robo-Advisors, Best Financial Advisors, Best Real Estate Platforms, Best Brokers for ETFs and Best Brokers for Mutual Funds.

Writers and editors conduct our broker and robo-advisor reviews on an annual basis but continually make updates throughout the year. We maintain frequent contact with providers and highlight any changes in offerings. The review team comprises seasoned writers, researchers and editors who cover stocks, bonds, mutual funds, index funds, exchange-traded funds, alternative investments, socially responsible investing, financial advisors, trade us options online, retirement and investment strategy on a daily basis.

In addition to NerdWallet, the work of our team members has been published in The New York Times, The Washington Post, Forbes, USA Today, Bloomberg News, Nasdaq, MSN, MarketWatch, Yahoo! Finance and other national and regional media outlets, trade us options online. The combined expertise of our Investing team is infused into our review process to ensure thoughtful evaluations of provider products and services from the customer perspective.

Our writers and editors combine to have more than 70 years of deep experience in finance, ranging from a former Wall Street Journal reporter to a former senior financial advisor at Merrill Lynch.

While NerdWallet does have partnerships with many of the reviewed providers, we manage potential conflicts of interest by maintaining a wall between our content and business operations. This wall is designed to prevent our writers and the review process from being influenced or impacted by our business partnerships. This way, all reviews can provide an unbiased review that serves the interests of our users. Summary of Best Options Trading Brokers and Platforms of September Broker NerdWallet Rating NerdWallet's ratings are determined by our editorial team.

Fees Account Minimum Promotion Learn More. Learn more. per trade. no promotion available at this time. View details. Pros Easy-to-use tools. Large investment selection. Excellent customer support.

Access to extensive research. Advanced mobile app. Cons Website can be difficult to navigate. TD Ameritrade. Promotion None. Pros Commission-free stock, Trade us options online and options trades.

Free research. High-quality trading platforms. No account minimum. Good customer support. Cons No fractional shares. Interactive Brokers IBKR Lite. Why we like it Interactive Brokers' IBKR Lite is a strong option for frequent traders: The broker offers international trade capabilities, no stock-trading commission and a quality trading platform.

Pros Large investment selection. Strong research and tools. Cons Website is difficult to navigate. Why we like it Webull will appeal to the mobile-first generation of casual investors with its slick interface for desktop and mobile apps, but the brokerage also delivers an impressive array of tools for active traders.

Pros Low costs. Easy-to-use platform. Advanced trade us options online. Access to cryptocurrency. Cons No mutual funds. Thin educational support. Promotion 1 Free Stock. Pros No account minimum. Streamlined interface. Cryptocurrency trading. Cons No retirement accounts. No mutual funds or bonds. Limited customer support. Pros High-quality trading platforms.

Comprehensive research. Active trader community. Cons Free trading on advanced platform requires TS Select. Plans and pricing can be confusing. Zacks Trade. per share. Why we like it Zacks is a great choice for experienced and active investors who would appreciate a little extra support from a representative, but trades cost more than at competitors. Pros Ample research offerings.

Robust trading platform. Access to international exchanges. Cons Trails competitors on commissions. High account minimum. Ally Invest. Merrill Edge, trade us options online.

Option Trading Canada! Interactive brokers Canada, Questrade or ThinkorSwim

, time: 10:39Options Trading | Share Trading Platform | CMC Markets

02/08/ · Saxo is generally one of the better value brokers for larger traders where you can trade stock options from USD , EUR 1 or GBP 1. Saxo markets provides access to 1,+ listed options from 23 exchanges worldwide, across equities, indices, interest rates, energy, and metals. See blogger.com: Richard Berry 06/06/ · USA law states any profits earned from binary options trading are subject to US tax. You must report the income as either capital gains or revenue to the IRS. If you are making a small amount, then the money can be declared as income; however, if it is a significant amount, then it must be reported as capital gains blogger.comted Reading Time: 10 mins E*TRADE charges $0 commission for online US-listed stock, ETF, and options trades. Exclusions may apply and E*TRADE reserves the right to charge variable commission rates. The standard options contract fee is $ per contract (or $ per contract for customers who execute at least 30 stock, ETF, and options trades per quarter)

No comments:

Post a Comment