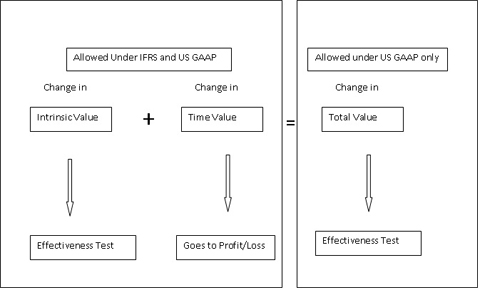

22/01/ · Accounting for derivatives under IFRS falls under IFRS 9 (Previously IAS 39) – Financial Instruments. Recognition and Initial Measurement: At inception, contracts generally have a fair market Reviews: 4 IFRS 9 provides an accounting policy choice: entities can either continue to apply the hedge accounti ng requirements of IAS 39 until the macro hedging project is finalised (see above), or they can apply IFRS 9 (with the scope exception only for fair value macro hedges of interest rate risk). This accounting policy choice will Similarly to intrinsic value of an option, an entity can designate only the spot element of a forward contract as a hedging instrument (IFRS (b)). If this is the case, the general accounting requirements for the forward element and foreign currency basis spread are the same as for the intrinsic value of an option (IFRS Estimated Reading Time: 14 mins

Hedge Accounting (IFRS 9) • blogger.com

Forward Exchange Contracts FEC or Fx options ifrs Exchange Options Options are Financial Instruments. Other financial instruments include Cash, Shares, Bonds etc. Due to recent international and domestic accounting changes, specifically around financial instruments after the financial crisis, researching and having confidence in the current treatment can be onerous. A common misconception is that using foreign exchange contracts to hedge foreign currency risk means that a company will adopt hedge accounting.

However, hedge accounting can be time consuming to adopt and stay on top of due to the documentation, monitoring and disclosure requirements. To better illustrate the mechanisms at play, we have provided an example and the corresponding journal entries, fx options ifrs.

In Canada, the most common financial reporting framework for Small or Medium Enterprises SMEs is Accounting Standards for Private Enterprises ASPE. Recognition and Initial Measurement: At inception, contracts generally have a fair market value of nil and therefore, an initial recognition entry is usually not required. Subsequent Measurement: Forward and option contracts when a fx options ifrs has not adopted hedge accounting are accounted for at their fair value.

The position of the contract is marked to market, and all gains or losses are recognized in net income. Derecognition: When contracts are settled, they are derecognized by removing the corresponding derivative asset or liability from the balance sheet.

Due to recent international and domestic accounting changes, researching and having confidence in the current accounting treatment of Forwards and Options can be onerous.

I've written a short article to help clients better understand the accounting treatment of these financial instruments. September 24, fx options ifrs, January 21, Published By Matthew Gustavson, CPA, CA Chief Financial Officer at Meed Growth. Sign in to leave your comment. Show more comments. More from Matthew Gustavson, CPA, CA 6 articles. FX Swaps, their use and how to account for… April 26, fx options ifrs, IFRS 9 - Accounting for Forwards and Options January 21,

FX Options Vol Converter

, time: 3:53Derivatives and Embedded Derivatives (IFRS 9) • blogger.com

Similarly to intrinsic value of an option, an entity can designate only the spot element of a forward contract as a hedging instrument (IFRS (b)). If this is the case, the general accounting requirements for the forward element and foreign currency basis spread are the same as for the intrinsic value of an option (IFRS Estimated Reading Time: 14 mins 22/01/ · Accounting for derivatives under IFRS falls under IFRS 9 (Previously IAS 39) – Financial Instruments. Recognition and Initial Measurement: At inception, contracts generally have a fair market Reviews: 4 14/10/ · An option or automatic provision to extend the remaining term to maturity of a debt instrument is closely related to the host debt instrument and need not be separated if there is a concurrent adjustment to the approximate current market rate of interest at the time of the extension (IFRS 9.B(b))

No comments:

Post a Comment