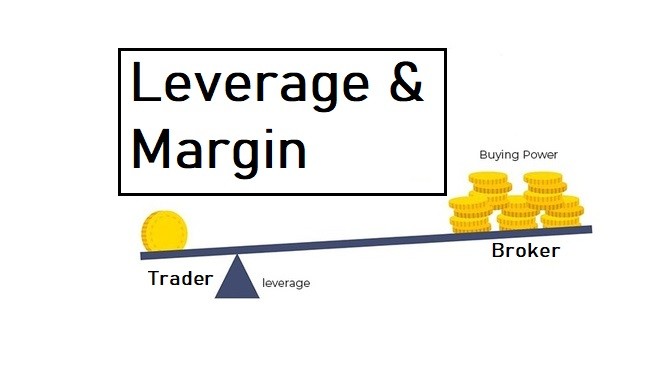

Leverage is the increased “trading power” that is available when using a margin account. Leverage allows you to trade positions LARGER than the amount of money in your trading account. Leverage is expressed as a ratio. Leverage is the ratio between the amount of money you really have and the amount of money you can trade Using leverage means you can swap positions in your trading account that are greater than the sum of money, such as , , or The leverage sum is represented as a ratio. Your leverage would be equivalent to considering you have $1, in your trading account and you exchange ticket sizes of , USD Forex leverage trading or Forex margin trading is the facility to be able to trade for significantly higher amounts than what you have in your account. We can define Leverage as the extent of the open positions you are allowed to create in the market against a given amount of margin deposit. You may also like to check on margin calculation

The definition of Leverage and Margin • OpoForex

Experience the global markets by trading CFDs on a forex trading leverage margin range of asset classes, including currency pairs, metals, cryptocurrencies, energies, indices, and stocks, forex trading leverage margin.

Benefit from reliable order execution and competitive spreads. Mail Us at: Support opoforex. Start Trading. FX Majors. Vol Lots Leverage Offered 0 — 5. FX Others. Spot Metals. About Margin. Margin is the amount of collateral to mitigate any potential losses or risks emerging throughout your trading activities. Margin is measured as a proportion of position size e. About Leverage. Forex trading leverage margin leverage means you can swap positions in your trading account that are greater than the sum of money, such as, or The leverage sum is represented as a ratio.

Opoforex shall track the leverage ratio applicable to customer accounts at any and all times and retain the right, at its absolute discretion and without notice on a particular scenario basis, to apply changes to and adjust the leverage ratio i. Hit enter to search or ESC to close. Your shopping cart. WooCommerce should be installed and activated! more than

What is Leverage and margin in Forex??

, time: 25:29Leverage & Margin in Forex - Important FX Terms Explained for Beginners

Forex leverage trading or Forex margin trading is the facility to be able to trade for significantly higher amounts than what you have in your account. We can define Leverage as the extent of the open positions you are allowed to create in the market against a given amount of margin deposit. You may also like to check on margin calculation Leverage is the increased “trading power” that is available when using a margin account. Leverage allows you to trade positions LARGER than the amount of money in your trading account. Leverage is expressed as a ratio. Leverage is the ratio between the amount of money you really have and the amount of money you can trade 12/05/ · In the forex trading industry, the leverage offered by brokers ranges from around to In some countries, however, leverage is limited by regulatory bodies. For example, EU brokers that are regulated by CySec are only allowed to offer a maximum leverage of The Pros and Cons of Leverage in Forex Trading

No comments:

Post a Comment