A Forex currency strength meter indicator measures the strength of individual currencies. It makes it easy to know which currencies are strong and which one are weak 11/06/ · Relative Currency Strength Indicator sell strategy The value of base currency should be 40 or below. The value of denominator currency should be above Wait for the candle to close as bearish. Mark the swing area and place stop-loss around Estimated Reading Time: 5 mins To become a successful trader it is important to understand the relative strength of each currency. This indicator helps traders see which trading pairs are the strongest and which are the weakest on different time scales. With this information traders will have a great advantage on their operations. The Currency Strength Indicator is fully configurable and designed to optimise trading success

Currency Strength Meter - Live Strength Indicator

The Relative Currency Strength indicator tries to find the strength and weakness of individual currencies and currency pairs. The findings can then be used to help decide which currency pairs to trade and in which direction.

The indicator can be used on your trading platform charts to help filter potential trading signals as part of an overall trading strategy.

As the name implies, the Currency Strength indicator is a unique forex indicatorwhich indicates the strength of a given currency over other currencies. At the same time, the relationship between currency pairs is organized according to their strength or weakness. The currency strength indicator helps to understand the conflicting market trends.

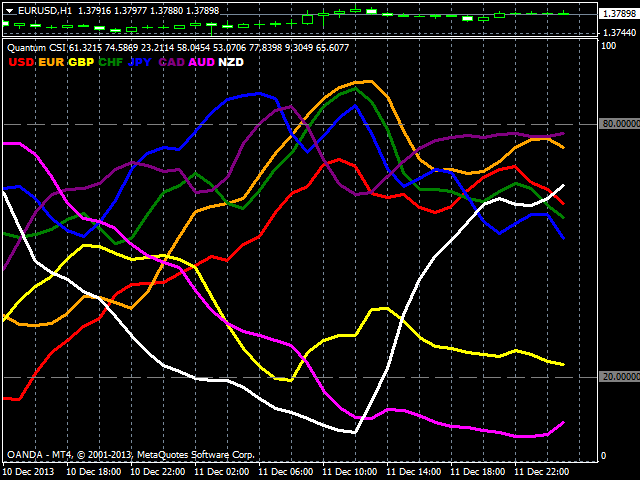

You can use this indicator to estimate when the currency is in trend and when it can reverse the trend. However, not all currency strength indicators are created equal. Some may be based on the rate of change ROC or RSI or CCI or some correlation between markets. So, the formula for calculating the currency strength should be well tested. Hence, the relative currency strength indicator uses an exclusive trading formula that aggregates prices over time, and it weights to create the most effective indicator of currency strength, forex relative currency strength indicator.

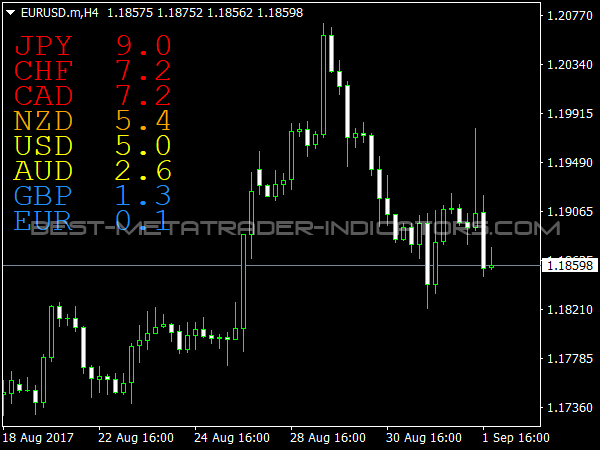

When using the currency strength indicator, we analyze each currency separately and not the currency pairs. The idea is to determine the strongest currency and the weakest currency so that you can choose the right currency pair for trading. In other words:. For example, the strongest currency is the Canadian Dollar, and the Japanese Yen is the weakest one.

Another way to use this indicator is to find the reversal of trend. Forex forex relative currency strength indicator can wait until one currency shows an extremely strong value, while the other currency is extremely weak and attempt to trade with a reversal.

Like the above chart shows CAD at extreme upside while JPY on the extreme downside, forex relative currency strength indicator. Therefore, the traders may look for selling opportunity in the same pair as well. There is a risk that the currency will continue to strengthen or getting weaker and weakerand you will be stuck in a bad trade. You may use the indicator as a confirmation tool for trading or you can use it as a standalone trading strategy.

Relative Currency Strength indicator tries to find the strength and weakness of individual currencies and currency pairs. The findings can then be used to decide which currency pairs to trade an in which direction. I would prefer to use the majority of technical indicators such as the Relative Currency Strength indicator on the 1-hour charts and forex relative currency strength indicator. I tend to find that these charts contain less market noise than the lower time frames and thus give more reliable signals for my forex trading strategies.

This also means that I spend less time staring at charts and can also set alert notifications to let me know when price has reached certain levels or a particular indicator value has been reached. The Relative Currency Strength indicator is just one indicator amongst thousands. I would not build a trading system alone, forex relative currency strength indicator, but rather combine with other technical indicators such as moving averages, Parabolic SAR, forex relative currency strength indicator, Stochastic Oscillator, forex relative currency strength indicator, RSI, ADX and price action analysis.

Of course, every trading system will generate false signals which is why money management is so important. I would personally be implementing sensible money management and only take traders that give me a favorable risk to reward ratio, ideally of at least This means that one losing trade does not wipe out consecutive forex relative currency strength indicator. The methods of implementing the Relative Currency Strength indicator into a trading strategy that are outlined within forex relative currency strength indicator article are just ideas.

I would always ensure that I have good money management, trading discipline and a trading plan when using any forex strategy. Furthermore, I would combine multiple technical analysis, fundamental analysis, price action analysis and sentiment analysis to filter all entries. You should trade forex in a way that suits your own individual style, needs and goals.

If you would like to practice trading with the Relative Currency Strength indicator, you can open an account with a forex broker and download a trading platform. If you are looking for a forex broker, you may wish to view my best forex brokers for some inspiration. Skip to content Home Best Forex Robots Best Forex Indicator Best Forex Brokers Compare Forex Brokers Free Forex Robot.

Home Best Forex Robots Best Forex Indicator Best Forex Brokers Compare Forex Brokers Free Forex Robot. Search for:. What is the Relative Currency Strength indicator?

Adam Khoo - Currency Strength Meter CSM Download \u0026 Learn to Use The Most Powerful Forex Trading Tool

, time: 12:45What Is The Relative Currency Strength Indicator & How To Trade With It - The Forex Geek

27/06/ · EUR= (iMA ("EURUSD",0,PerAvr,0,MODE_LWMA,PRICE_CLOSE,i)-iMA ("EURUSD",0,PerAvr*M,0,MODE_LWMA,PRICE_CLOSE,i)); The only other pair I can think of that may be used is TRY, so to replace Euro with try, you would replace the line above with: TRY= (iMA ("USDTRY",0,PerAvr,0,MODE_LWMA,PRICE_CLOSE,i)-iMA Live Currency Strength Indicator. The currency strength meter is a graphical representation of the strength or weakness of currencies in the Forex market. You can see the relative strength of all majors. Traders can use currency strength to predict currency movements when making decisions for the best trading opportunities A Forex currency strength meter indicator measures the strength of individual currencies. It makes it easy to know which currencies are strong and which one are weak

No comments:

Post a Comment