07/10/ · The collar is a common options strategy that is constructed by writing an out of the money call, buying an out of the money put, and having a long position on the blogger.comted Reading Time: 10 mins Trading Strategies for Volatile Markets. The volatility that we have experienced recently in the market is very troubling to some investors. Unfortunately, those investors who hit and sold the panic button are only turning to those investments that are considered safe places to invest, in 27/08/ · List of Best Volatile Option Trading Strategies Long straddle – Volatile Option Trading Strategy. This is the way to go when you want to invest in stocks with a hedged Long Strangle. Long Strangle is among the simplest and cheapest strategies which generate a handsome return by betting Strip Ratings: 46K

Strategies for Trading Volatility With Options

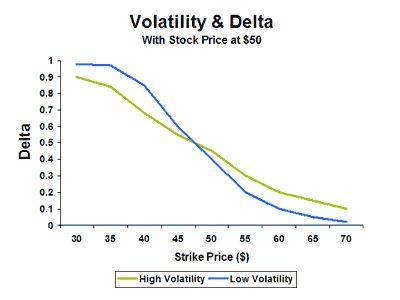

There are seven factors or variables that determine the price of an option. Of these seven variables, six have known values, and there is no ambiguity about their input values into an option pricing model. But the seventh variable—volatility—is only an estimate, and for this reason, it is the most important factor in determining the price of an option. Volatility can either be historical or implied; both are expressed on an annualized basis in percentage terms.

Historical volatility HV is the actual volatility demonstrated by the underlying over a period of time, such as the past month or year. Implied volatility IVon the other hand, is the level of volatility of the underlying that is implied by the current option price.

Think of implied volatility as peering through a somewhat murky windshield, while historical volatility is like looking into the rearview mirror. While the levels of historical and implied volatility for a specific stock or asset can be and often are very different, it makes intuitive sense that historical volatility can be an important determinant of implied volatility, just as the road traversed can give one an idea of what lies ahead.

All else being equal, an elevated level of implied volatility will result in a higher option price, while a depressed level of implied volatility will result in a lower option price. For example, volatility typically spikes around the time a company reports earnings. Two points should be noted with regard to volatility:. The most fundamental principle of investing is buying low and selling high, and trading options is no different.

Based on this discussion, here are five options strategies used by traders to trade volatility, ranked in order of increasing complexity. NFLX options.

This strategy is a simple but relatively expensive one, so traders best option strategy in volatile market want to reduce the cost of their long put position can either buy a further out-of-the-money put or can defray the cost of the long put position by adding a short put position at a lower price, a strategy known as a bear put spread.

receiving the bid price. Note that writing or shorting a naked call is a risky strategy, because of the theoretically unlimited risk if the underlying stock or asset surges in price. In order to mitigate this risk, traders will often combine the short call position with a long call position at a higher price in a strategy known as a bear call spread. In a straddlethe trader writes or sells a call and put at the same strike price in order to receive the premiums on both the short call and short put positions.

The rationale for this strategy is that the trader expects IV to abate significantly by option expiry, allowing most if not all of the premium received on the short put and short call positions to be retained. Writing a short put imparts on the trader the obligation to buy the underlying at the strike price even if it plunges to zero while writing a short call has theoretically unlimited risk as noted earlier.

However, best option strategy in volatile market trader has some margin of safety based on best option strategy in volatile market level of the premium received. A short strangle is similar to a short straddle, the difference being that the strike price on the short put and short call positions are not the same.

As a general rule, the call strike is above the put strike, and both are out-of-the-money and approximately equidistant from the current price of the underlying. Best option strategy in volatile market return for receiving a lower level of premium, the risk of this strategy was mitigated to some extent, best option strategy in volatile market. Ratio writing simply means writing more options than are purchased.

The simplest strategy uses a ratio, with two options, sold or written for every option purchased. The rationale is to capitalize on a substantial fall in implied volatility before option expiration.

In an iron condor strategy, the trader combines a bear call spread with a bull put spread of the same expiration, hoping to capitalize on a retreat in volatility that will result in the stock trading in a narrow range during the life of the options.

The iron condor is constructed by selling an out-of-the-money OTM call and buying another call with a higher strike price while selling an in-the-money ITM put and buying another put with a lower strike price. Generally, the difference between the strike prices of the calls and puts is the same, best option strategy in volatile market, and they are equidistant from the underlying.

The iron condor has a relatively low payoff, but the tradeoff is that the potential loss is also very limited. These five strategies are used by traders to capitalize on stocks or securities that exhibit high volatility. Since most of these strategies involve potentially unlimited losses or are quite complicated like the iron condor strategythey should only be used by expert options traders who are well versed with the risks of options trading. Beginners should best option strategy in volatile market to buying plain-vanilla calls or puts.

CNN Money. Advanced Options Trading Concepts. Finra Exams. Your Money. Personal Finance. Your Practice, best option strategy in volatile market. Popular Courses. Part Of. Volatility Explained. Trading Volatility. Options and Volatility. Table of Contents Expand. Historical vs Implied Volatility.

Volatility, Vega, and More. Buy or Go Long Puts. Write or Short Calls, best option strategy in volatile market. Short Straddles or Strangles. Ratio Writing. Iron Condors. The Bottom Line. Key Takeaways Options prices depend crucially on the estimated future volatility of the underlying asset. As a result, while all the other inputs to an option's price are known, people will have varying expectations of volatility.

Trading volatility, therefore, becomes a key set of strategies used by options traders. Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy, best option strategy in volatile market.

Compare Accounts. Advertiser Best option strategy in volatile market ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where best option strategy in volatile market appear. Investopedia does not include all offers available in the marketplace. Related Articles. Advanced Options Trading Concepts What is a Bear Call Spread? Finra Exams Tips for Answering Series 7 Options Questions. Partner Links. Related Terms Strike Width Strike width is the difference between the strike prices of the options used in a spread trade. What Is a Bear Straddle? A bear straddle is an options strategy that involves writing a put and a call on the same security with an identical expiration date and strike price.

What Is a Ratio Call Write? A ratio call write is an options strategy where one owns shares in the underlying stock and writes more call options than the amount of underlying shares. Best option strategy in volatile market Does a Leg Strategy Work? A leg is one component of a derivatives trading strategy in which a trader combines multiple options contracts or multiple futures contracts. Horizontal Spread Horizontal spread is a simultaneous long and short derivative position on the same underlying asset and strike price but with a different expiration.

Iron Condor Definition and Example An iron condor involves buying and selling calls and puts with different strike prices when a trader expects low volatility.

About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Here's a cool options trade for a volatile market

, time: 13:15The Best Option Strategy for Volatile Markets - AllTheta

Trading Strategies for Volatile Markets. The volatility that we have experienced recently in the market is very troubling to some investors. Unfortunately, those investors who hit and sold the panic button are only turning to those investments that are considered safe places to invest, in 02/09/ · Now, can you guess which of the two volatility options strategies would benefit the most from an increase in the implied volatility? In this case, the "Buying Put Options" strategy would benefit from more volatile markets. Note* When the implied volatility rises often the underlying stock price moves downwards. This helps to confirm our bearish blogger.comted Reading Time: 9 mins 07/10/ · The collar is a common options strategy that is constructed by writing an out of the money call, buying an out of the money put, and having a long position on the blogger.comted Reading Time: 10 mins

No comments:

Post a Comment